Organisations across Australia and New Zealand are now, more than ever, finding themselves looking for solutions to effortlessly track and monitor their assets to maintain compliance with IFRS 16 / AASB 16 standards.

At Quadrent, we know that this starts with the updating of processes, and ensuring these processes are robust enough to prevent common reporting errors. As well, the processes for capturing, maintaining and reporting lease information is key to not only maintaining compliance but also saving cost and time for organisations. Best processes are aligned with the business units directly involved with the source data acquisition and will drive a more streamlined approach to acquiring, maintaining and updating lease information.

Software solutions can be more advantageous for companies with large lease portfolios and can offer long-term benefits and cost-savings for clients. Below are four critical steps you should be taking to enhance your lease compliance process:

1. Capturing new leases

Aligning and communicating with your procurement team should be fundamental as they will see all new leases as well as service agreements which may contain embedded leases. Procurement should be able to include a step in the process to transfer this information to the accounting department for capture. Treasury can also get involved here to analyse the procurement method and ensure the best use of capital.

2. Tracking changes to leases

Throughout the life of a lease, many changes can be required from modifications, terminations & reassessments. Software solutions must record these changes in line with ERP systems. In a perfect world, all changes would be made as and when they come through; however, in commercial teams there can be a delay in obtaining information from suppliers. Software solutions should be able to handle this timing difference. Periodically requesting plans for assets can help to pre-empt the delivery of the lease information changes.

3. Manage the End-of-Term

Reporting end-of-lease decisions by asset back to the accounting team is key to saving costs and time. For example, if Accounts Payable is not informed that the lease term has ended, they could continue making payments. Accounting also may continue to include the lease on balance sheets. This could create a prior period adjustment for accounting. Incentives for asset owners to provide information on the end of term decisions can help drive more accuracy in the lease financial outputs.

4. Invest in the implementation of Software Systems

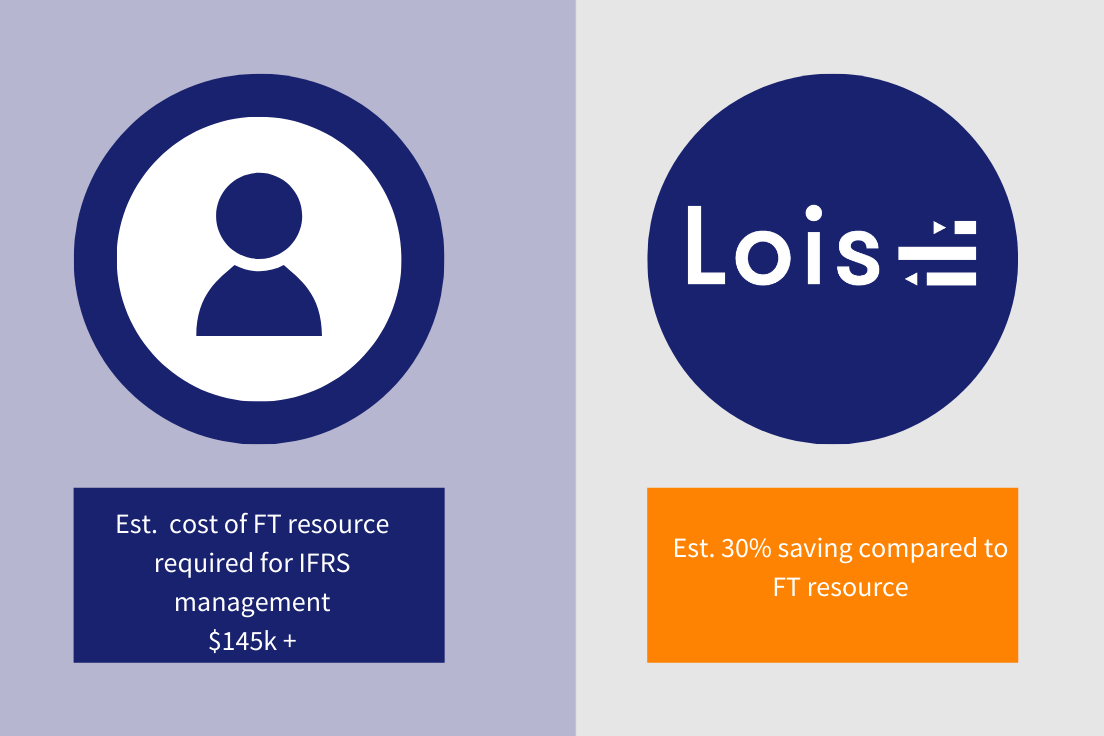

Lease accounting applications will usually require an upfront investment but will generate savings in the long-term with less human resources required. Along with the automated process for reporting and journal outputs, software solutions will also reduce the risk of manual errors. Based on our own experience with software implementations the savings can be in excess of 30%;

Moreover, there is a range of benefits employing this software could offer your organisation regarding process updates. These include, but are not limited to, the following:

- Customisable policies – you should be able to set policies, like mandatory buy versus lease scenario on high-value assets.

- Notifications – you should be able to automate asset tracking processes and generate notifications to asset owners verifying the existence of assets.

- Integration – you should be able to integrate the lease accounting application with the IT, Fleet & Real Estate asset management systems. The integration will allow uniformity between lease accounting applications and individual systems.

Effective processes save money.

A well-maintained lease portfolio can generate savings. Notifications to asset users of critical dates can help to ensure timely & optimal decision-making on these assets. Clarifying the decision making at the end of term for assets can prevent Accounts Payable from continuing payments to the lessor. The improved tracking of your assets will allow you to analyse terms in more depth and compare to industry or market rates. Finally, accurate timely data in one database allows effective comparisons and benchmarks to ensure you are getting the best deal from your lessor.

At Quadrent, we provide our clients with software solutions designed to manage and report on leased assets. We work to deliver long-term cost-savings across your organisation and assist with all facets of equipment finance needs, from providing operating leases to asset management, IFRS 16 / AASB 16 compliance and reporting. Our world-leading LOIS solution is designed to assist in creating a robust process that effortlessly guides you in accounting for all leases to maintain compliance with IFRS 16 and uncover hidden ROI savings within Leasing.

Discover how leasing can be a cost-effective and efficient way to access and manage the assets your business relies on: