For many businesses, buying the equipment you need can be expensive. Asset management represents a large part of many companies' budgets. Depending on how you intend to use the asset, leasing might be a more cost-effective option. That said, if you’re not used to leasing, it can be difficult to tell whether it can save you money.

This article compares leasing to buying, demonstrating how you can decide which is better for your business.

Understanding The Total Cost of Ownership

To understand the benefits of leasing compared with purchasing, it’s important to consider the total cost of ownership (TCO). TCO is an estimate of all the direct and indirect costs involved in acquiring and operating a product or system over its lifetime and is a widely accepted measure for conducting equipment cost assessments.

When assessing TCO, you need to look beyond the initial purchase price to include all the expenses associated with an asset over its lifetime, including operating, maintenance and disposal costs.

By doing so, you achieve a more accurate picture of the asset’s true cost. For example, when you buy a car, the purchase price is the upfront cost you pay to the dealer. It may include the cost of the asset itself and some on-the-road costs but does not include the ongoing costs to keep the car on the road. Using this value on its own to understand the asset cost is misleading at best.

On the other hand, the TCO for the car would include these costs, plus its future costs, like servicing, fuel, insurance and depreciation, over its usable life.

Similarly, with IT purchases, you need to consider the installation, software upgrade, hosting, maintenance, consumables, training, downtime, and help desk support expenses, when assessing the TCO.

How Leasing Affects TCO

Some of the factors used in calculating TCO will be the same whether leasing or buying. For example, you will need to pay for maintenance whether you lease the equipment, or whether you’ve purchased it outright. However, leasing does provide certain advantages when it comes to an asset’s TCO, particularly when it comes to IT.

Here are some examples of how leasing can lower TCO for IT assets:

|

Lower Interest Costs

|

With leasing, the lessor invests the estimated residual value (at the end of the lease term) of the asset upfront, effectively reducing the total price paid by the lessee in comparison with purchasing upfront.

|

|

Fixed Interest Costs

|

Unlike bank debt, as soon as the lease contract is signed the underlying interest rate is fixed (as the payments remain the same during the lease period).

|

|

Matching ownership life with the lease term

|

In a leasing arrangement, the ownership life of that asset for your business can be matched with the term of the lease agreement. Once the ownership life (usually three or five years) expires, costs associated with collection or disposal can be absorbed by your equipment finance partner.

|

|

Easier upgrades and lower indirect costs

|

Indirect costs can be incurred when the use of an asset stretches beyond its optimum life. Even though an asset ‘still works’, repair and maintenance costs and downtime generally increase. This can lead to lost business productivity, simply because a decision has not been made to replace or upgrade in a timely manner. Leasing makes it easier to hand back, upgrade and replace equipment when needed, delivering benefits in terms of efficiency, competitiveness, and maintenance costs.

|

Leasing vs Bank Finance Comparison

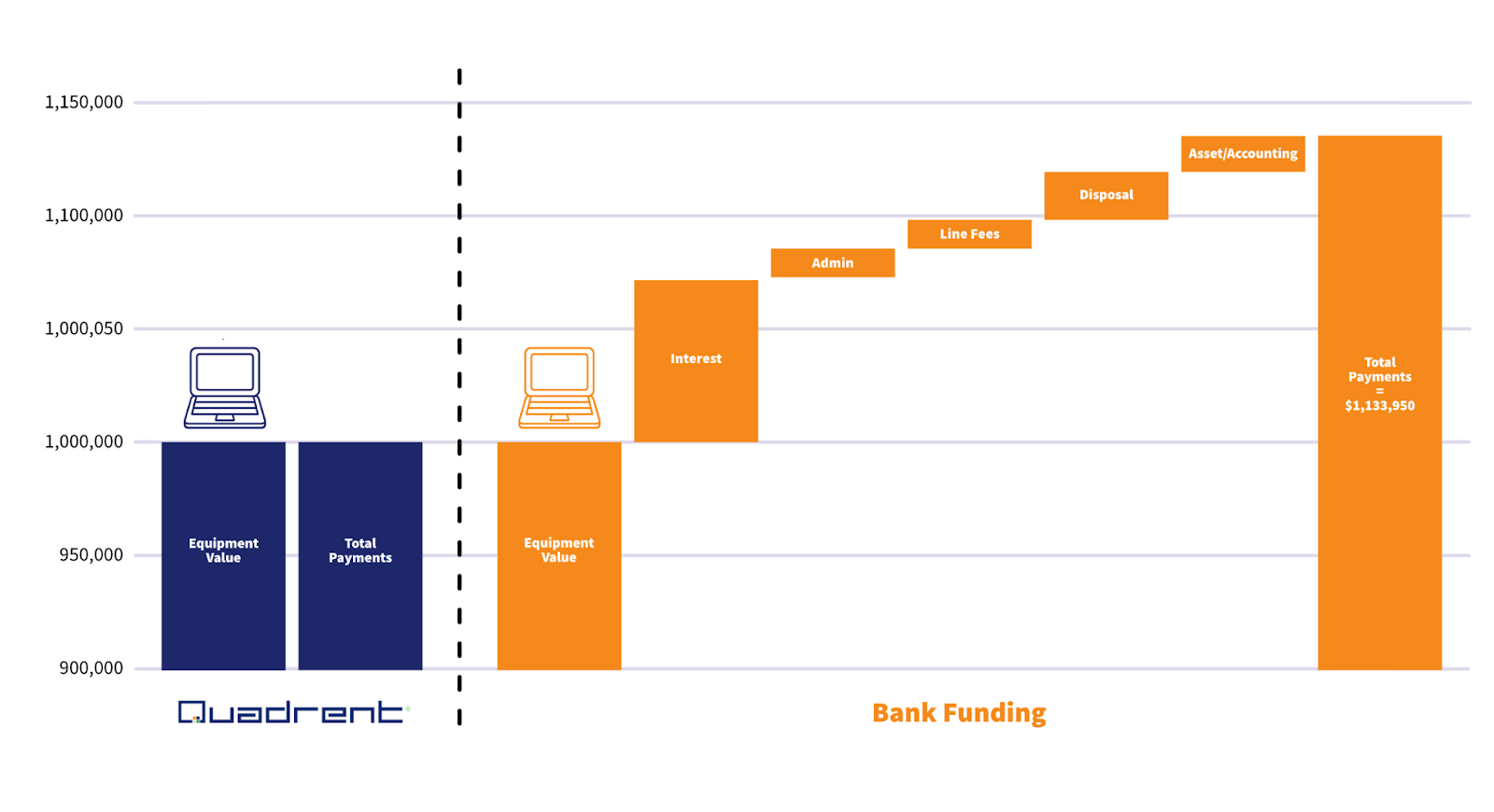

Here’s the financial model behind how leasing can be used to reduce your equipment TCO compared with bank funding, using an equipment value of $1,000,000 as an example, over a three-year lease.

The infographic below demonstrates the benefit of partnering with a specialised equipment financier like Quadrent. Due to the investment that Quadrent makes in the equipment, the effective interest rate to the customer becomes 0% resulting in the total payments over a lease period equalling the equipment value.

Furthermore, in a bank funding model, customers will typically incur the following additional costs:

- Administration costs: Customers will need to perform a range of administrative functions including supplier liaison, invoice reconciliation and payment processing.

- Banking facility: Under existing banking relationships clients will often have establishment and line fees, legal fees and associated charges. Line fees alone can be circa 1.5%. In addition, all bank facilities have reporting and covenants requirements which can be an onerous burden on the business especially within times of change. Lastly, the bank will often have a General security charge over all assets with the inherent cost to the business very hard to quantify. A lease simply has security over the leased assets.

- Equipment disposal: Customers will be responsible for the admin of asset removal, packaging, transportation, cleansing, sale process and receiving funds. In addition, in today’s more sustainable world there is an expectation of a responsible attitude to packaging material and disposal of material / Data erasure / E-waste / Asset retrieval & transportation costs. All these costs under ownership can quickly mount up and be outside the business’s area of expertise.

- Asset management and accounting: The client will be responsible for the accounting, reporting & budgeting, cost centre billing and general asset management. In the Quadrent full-service model below with LOIS–these costs are absorbed by us, ensuring the TCO is reduced even further:

Leasing Benefits

*Note this may not include commitment, line or swap fees.

*Note this may not include commitment, line or swap fees.

How Do I Start Leasing?

Leasing can be a powerful cost-saving strategy for many businesses. Yet, the complexities that come with managing and reporting on leased equipment can mean it’s often under-utilised.

Quadrent has a history of helping businesses cut through complexity. We’ve created an ebook providing a clear and straightforward guide to leasing. From the basics to a detailed comparison of the benefits of leasing versus buying. After reading this ebook, you'll be able to make procurement decisions with confidence. Download the ebook to learn more.