In 2024, the International Financial Reporting Standard 16 (IFRS 16) continues to reshape the financial landscape for large corporates. First implemented in January 2019, IFRS 16 requires companies to bring most leases onto their balance sheets, fundamentally altering how they report financials and manage leases. Its ongoing impact is significant, influencing transparency, financial metrics, and corporate strategies across industries.

Impact on Accountants

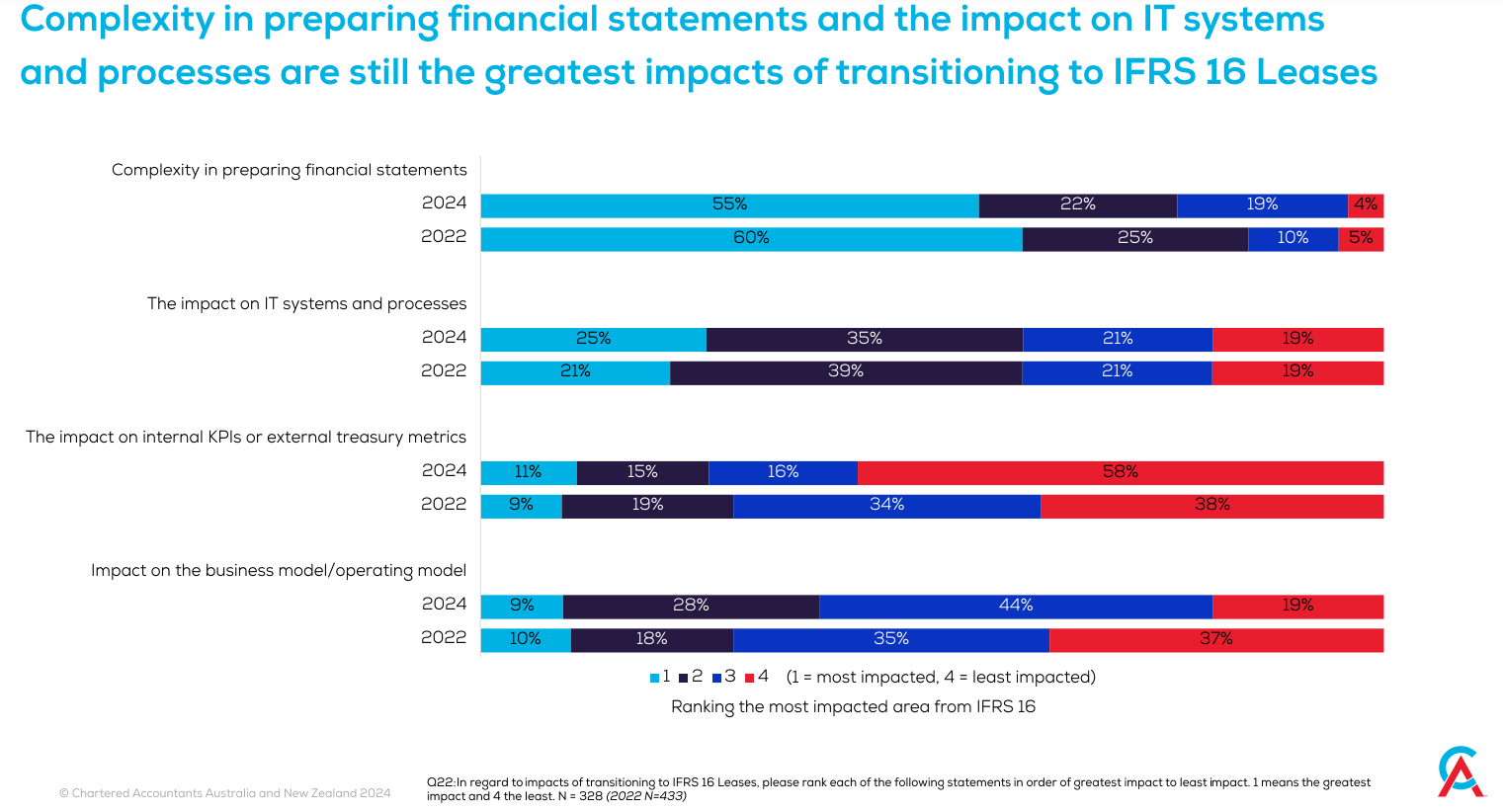

A 2024 survey conducted by Chartered Accountants Australia and New Zealand found that over 50% of Chartered Accountants reported a moderate to very significant impact from adopting IFRS 16. While this is slightly less than the 2022 survey results, the continued adaptation to the standard remains a key focus for finance professionals. This ongoing shift underscores the need for robust systems and processes to manage the complexities of lease accounting effectively.

Insights from the IASB's Post-Implementation Review

In June 2024, the International Accounting Standards Board (IASB) began a post-implementation review of IFRS 16. The review aims to assess whether the standard is working as intended and to identify areas that may need improvement. Initial findings suggest that IFRS 16 has generally achieved its objectives of increasing transparency and comparability. However, challenges remain, particularly in estimating lease terms and determining appropriate discount rates.

A New Era of Transparency

One of the most far-reaching changes brought by IFRS 16 is the increased transparency in corporate financial statements. By requiring companies to recognise lease liabilities and corresponding right-of-use assets, IFRS 16 eliminates the off-balance-sheet financing that was prevalent under the previous IAS 17 standard. This shift provides investors and stakeholders with a clearer and more accurate view of a company's financial obligations and overall health.

Challenges in Implementation

Despite the benefits of increased transparency, implementing IFRS 16 has posed challenges, especially for large corporates with extensive lease portfolios. Many organisations have faced hurdles in identifying, measuring, and reporting their lease obligations.

One notable example is the telecommunications industry, which leases substantial high-value assets such as network towers, satellite transponders, and fibre optic cables. Under IFRS 16, these assets and liabilities must now be included on the lessee's balance sheet. This required telecom companies to locate and account for numerous lease agreements previously treated as off-balance-sheet, which proved a complex and labour-intensive task. These companies also face challenges in efficiently processing accounting compliance while aiming to achieve a return on investment through centralised lease management systems.

The logistics industry, with its extensive leasing of fleets and material handling equipment (MHE), has also been significantly affected by IFRS 16. For logistics companies, the transition has required substantial investment in technology and systems to effectively manage their lease portfolios and maintain compliance.

Impact on Financial Metrics

The adoption of IFRS 16 has significantly affected key financial metrics. For many companies, the transition led to a marked increase in reported debt levels, as well as changes to EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortisation) figures. This shift has had ripple effects on financial ratios, loan covenants, and overall financial performance. Notably, the initial transition brought $32 trillion worth of assets onto corporate balance sheets, which radically transformed the financial landscape.

Strategic Adjustments

In response to the complexities introduced by IFRS 16, many large corporates have had to make strategic adjustments. Some companies have renegotiated lease terms to mitigate balance sheet impacts, while others have invested in specialised technology to better manage their lease portfolios. The use of lease accounting software platforms, such as LOIS (Lease Optimisation Information System), has become increasingly common. These platforms help finance teams maintain IFRS 16 compliance while providing a centralised database for leased assets.

Opportunities and Benefits

Despite the initial challenges, IFRS 16 also presents opportunities. The increased transparency and enhanced lease management capabilities provide corporates with the data needed for better decision-making and resource optimisation. Companies that have successfully navigated the transition are now in a stronger position to use their lease data strategically, resulting in potential cost savings and improved ROI.

Conclusion

As we progress through 2024, IFRS 16’s impact on large corporates continues to evolve. While the initial transition posed considerable challenges, the long-term benefits of greater transparency and improved lease management are becoming clearer. Corporates that embrace the necessary strategic adjustments and invest in appropriate tools and processes will be well-prepared to manage lease accounting complexities in the years ahead.

.png?width=1200&height=400&name=Property%20%26%20Finance%20webinar%20-%20Email%20banner%20(2).png)