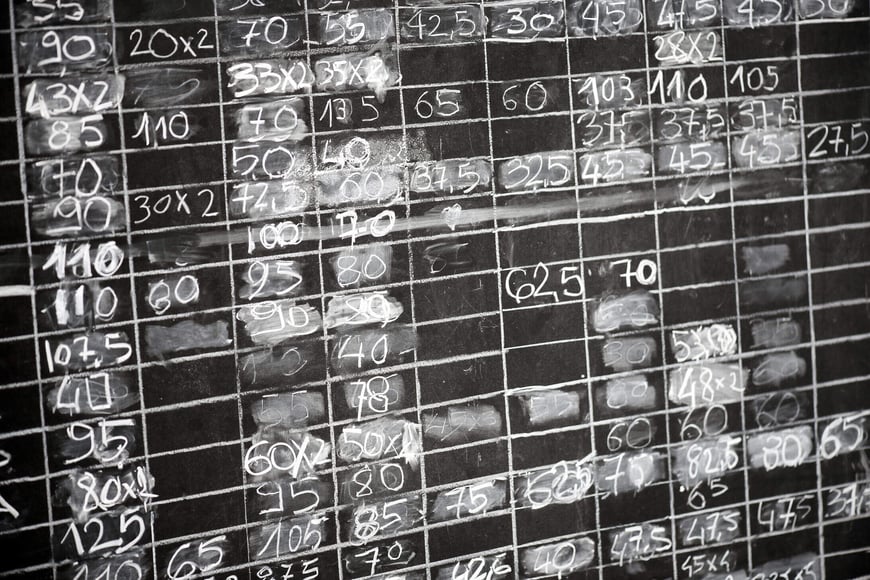

In the world of accounting, a spreadsheet is like a family member – something to rely on, something to trust, something to cuddle…well two out of three isn’t bad. Spreadsheets are a fundamental part of our accounting environment, but today we would like to look at some of the reasoning why the utilisation of just spreadsheets for such a business-critical task such as IFRS 16 compliance might be akin to reverting back to the classic blackboard and could possibly open your business up to risks that can be easily mitigated when using a specialised lease accounting system.

Why your business might consider a "Spreadsheet Solution":

- The business and its people are familiar with spreadsheets

- The existing lease portfolio is “held together’ on a spreadsheet or various spreadsheets

- You are being offered spreadsheet solutions as a path to compliance by advisors, auditors or internal parties.

- It seems cheap, familiar, easy, understandable and immediate

What can possibly go wrong?

The Spreadsheet Solution Risk

If you use spreadsheets in any capacity, then you should already know many of the points against. If you have read and understood the requirements of IFRS 16 then you will no doubt be conscious of some of the shortcomings of spreadsheets. If you have ever tried to understand the workings of another’s spreadsheet then you will already be reading ahead here to identify a robust, proven, trusted cloud-based solution.

Key requirements for any IFRS 16 solution are:

- Fast to deploy - fast to create its database, fast to implement IFRS 16, fast to execute amortisations and fast to access.

- Accessibility - Is it accessible to a multi-user environment where depending on authority levels individuals in that environment can have different levels of access and update capability?

- Systematic Controls - Including version control, well documented, continually developed, thoroughly tested and capable of creating its own audit trail of changes in software, leases, liabilities or assets.

- Consistency - in calculations, headings, inputs, validations, rounding, decimal points and reporting.

- Security - ensuring integrity, recover-ability and manageability such as cloud-based options provide.

- Automation - All leases are different but entering the detail as they are contracted needs to be straightforward, intelligible and consistent.

- Modifications – Proven calculations for your Business-as-Usual (BAU) requirements such as complex amortisation recalculations to reflect updates and changes. Daily discounting, termination notices, complex reporting options, general ledger journal creation.

- Support – Assistance, maintenance and regular training are key to successfully achieving and benefiting from compliance.

Ensuring data integrity

The most fundamental requirements for any system in the new world under IFRS 16 is Data Integrity and the ability to provide the correct outputs for a complex set of new rules that IFRS 16 has initiated.

Excel lacks the critical controls needed to preserve the integrity of your data. Spreadsheets are often restricted to one user at any given time and are always vulnerable to changes either through deliberate or accidental human interventions/errors that are extremely difficult to isolate and correct.

Just remember, an incorrect formula, misplaced decimal point or percentage and even a simple typo can dramatically alter the financial position of your organisation! Ensuring data quality through effective data validation is possible using Excel. However, this is a complex and time-consuming process and becomes problematic to change once created. This doesn’t even take into account other complex areas of the standard like FX treatment and retail calendars.

In summary

The spreadsheet will remain an integral part of our day-to-day accounting needs, but IFRS 16 brings about requirements that highlight the weaknesses of this tool.

In a world that is constantly looking for improvements in performance and efficiencies that drive through to the bottom line, IFRS 16 provides organisations a unique opportunity to review their lease portfolios from a centralised perspective to draw more efficiencies from both a process level as well as a financial one.

Unfortunately, a spreadsheet will not provide these in the long run – in the short term, yes potentially, but as your business moves into BAU in the new world, the shortcomings will become stark.

In need of a better solution?

Oh, by the way, if you did skip to here or ended up here anyway then you will likely, by now, understand the need for a dedicated solution and should look no further than LOIS www.loisleasing.com.au our Lease Optimisation Solution.

LOIS is a better and more strategic approach to IFRS 16 compliance and has been designed with lease accounting at its core. Not only have such solutions been coded and pre-programmed to produce all the complex calculations and reporting for you, they have also been rigorously tested to ensure the accuracy of the accounting outputs.

There is a cost to a system such as LOIS, but this is likely to provide an ROI for your business through reduced resource input required and as well as the reduction of costs for auditing, as something as simple as a systemised audit trail can tell an auditor there have been no changes since they last looked at the lease a year ago, so move to the next one, and so on. It is simple, but it adds up.

If you’re looking for a solution that is superior to spreadsheets and indeed to many other systems purporting to do IFRS 16 calculations to the new lease accounting standards discover how LOIS Lease Accounting will help - download our product brochure or see for yourself by scheduling a demo with one of our IFRS 16 experts.

For lease portfolio’s of less than 100 leases, please ask us about our new Managed Service offering!

Disclaimer: this article contains general information about the new lease accounting standards only and should NOT be viewed in any way as professional advice or service. The Publisher will not be responsible for any losses or damages of any kind incurred by the reader whether directly or indirectly arising from the use of the information found within this article.