Managing a company’s lease data with software that makes IFRS 16 compliance efficient and simple is one of the key benefits of making the change from legacy systems, such as spreadsheets. And for those companies that have stored and managed their lease data in a centralised location, there’s the added benefit of having valuable data that can be analysed to both maximise the ROI of leases and save money. Quadrent, in collaboration with Unisphere, recently hosted a webinar outlining how companies can use their lease data for stronger commercial decision making and lowering spending.

View the webinar recording here and keep reading below for a summary of what was discussed.

Don’t waste your data

With the digitisation and integration of systems, companies are collecting more data than ever before. For many companies, this data is often wasted instead of being analysed to identify trends, gain insights, and make stronger commercial decisions. And with data now considered more valuable than oil, the value that companies extract from their data is dependent on their ability to analyse it.

Use your data to identify trends in leasing

The transition to IFRS 16 led to companies centralising their leasing data for the first time. With this data captured and used for compliance and reporting for over three years, there’s now an opportunity to analyse it. Through our IFRS 16 lease accounting software, LOIS, we have the ability to provide our customers with insightful analytics and trends through a customised lease analytics dashboard benchmarked against 60,000 leases across 3.2 million data points and $34 billion right of use (ROU) assets, enabling organisations to make informed decisions about their business. Areas of analysis that a company may derive value from include asset locations, asset classes, global markets and how they’re changing, and future scenario analysis to identify levers that a company may pull to have a higher likelihood of achieving its objectives.

Lease accounting trends

According to EY’s Global Lease Accounting Survey 2022, most respondents (70 per cent) use their lease accounting software for accounting and IFRS 16 compliance. Further, only 6 per cent have an end-to-end solution that includes competitive bidding of equipment leases through to end-of-life management, limiting the opportunity to maximise cost savings and overall efficiency. Among the respondents, 80 per cent of companies also aren’t using their lease accounting system to create ROI, and only 20 per cent of companies have adjusted their incremental borrowing rate (IBR) correctly. For companies that use their leasing data to realise savings and maximise their ROI, data analysis can, at a minimum, cover the cost of the lease accounting software.

IBR benchmarking

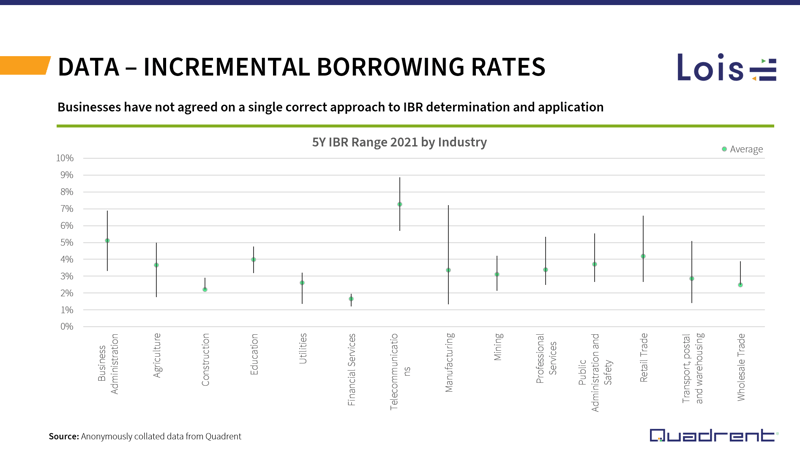

As an example, an Incremental Borrowing Rate Market Analysis and Trends Report collated in partnership with Deloitte demonstrates the disparity between IBRs across industries over five years. Analysing lease data in this way provides a benchmark for companies to determine if they should be adjusting their IBR for more accuracy and financial stability.

How to best use your data for strong lease decisions

The strength of commercial decision making that can be realised with lease data is contingent on how data is gathered, stored and used. Companies should aim to use the full lease lifecycle data to drive transformation and automation to drive ROI. These objectives are largely achieved through two key factors: centralisation and systems integration. Companies should now leverage their hard work in familiarising themselves and complying with the IFRS 16 standards to optimise information flows by centralising and automating administration and accounting tasks and decentralising information sourcing.

Centralised versus decentralised

According to EY, 70 per cent of companies don’t have a centralised lease vs buy process. While IFRS 16 drove a shift to centralising decision making, accessing source data and ensuring data is always current is critical to having a strong data flow. For example, where companies had centralised decision making in the IFRS 16 transition, there should also be a process for collecting regular data updates. This involves decentralising the data flow so that people with commercial knowledge of the company’s assets provide regular and accurate reporting to financial administrators and decision-makers.

Key steps to establish strong data infrastructure and systems

Before a company starts collecting data, there should be a strategy to determine how the data will be analysed to provide information and knowledge to the people in the organisation that will derive the most value from it. The data captured, without these steps, is simply a collection of numbers and data points. Before embarking on developing a data strategy and building the technology systems and infrastructure to collect, store and analyse data, companies should seek independent advice to identify an approach that is fit for purpose. An independent expert can also help your company to establish an effective master data management approach, data dictionary, documentation, governance, and automation. This ensures data is collected, stored and analysed securely and efficiency.

How lease data can be used to achieve sustainability goals and complete ESG reporting

ESG requirements are growing, and mandated reporting is being introduced in jurisdictions around the world. Companies who proactively start measuring their ESG performance through leveraging their current data, such as leasing data, have an effective starting point for their ESG journey. Similarly, accessing sustainable finance through Quadrent’s Green Lease helps companies access the best assets while providing positive social impacts.

Maximise your leasing ROI and master your reporting with Quadrent

With companies well into the journey of IFRS 16 compliance, there’s a significant opportunity to leverage the data captured to maximise their ROI and visualise data for commercial experts across the business. This provides the underlying data for the growing number of stakeholders and considerations in commercial decision making that need to be addressed. Further, engaging a trusted partner to provide independent advice, from the data strategy stage to analysing lease data to gain business intelligence, will provide companies with levers to pull that can save money, maximise asset values, and collect, store, and use data securely and efficiently.

Quadrent works with businesses helping them to accurately manage their leases, improve IFRS 16 compliance data inputs and proactively manage their ESG risk. With a team that has in-depth leasing knowledge and specialised accounting backgrounds, we’ll help you get the most value out of your assets while addressing increasing ESG requirements.

To leverage your data and start your ESG journey simply and effectively with Quadrent. Click here for more information.