With the current environment in a constant state of change it's important to ensure your Incremental Borrowing Rate (IBR) is up-to-date and correct, especially for modifications. This will help avoid any compliance issues or balance sheet inaccuracies down the track.

If you are unsure of why an IBR is important or how to calculate it, our friends at Deloitte have put together some handy FAQs covering the what, why, when and how of IBR.

What is an Incremental Borrowing Rate?

IBR is defined as the rate of interest that a lessee would have to pay to borrow, over a similar term and with a similar security, the funds necessary to obtain an asset of a similar value to the right-of-use asset in a similar economic environment.

Why do I need to use the Incremental Borrowing Rate?

IFRS 16/AASB 16 requires lessees to recognise assets and liabilities for all leases, excluding short-term and low-value leases. The lease liability is measured as the present value of future lease payments, discounted using the interest rate implicit in the lease if this can be readily determined or, if not, using its IBR.

IFRS 16/AASB 16 requires the discount rate applied to leases to take into account the credit profile of the lessee, the lease length, the nature and quality of any collateral and the underlying economic environment at the assessment date. Since the interest rate implicit in the lease requires knowledge of the asset fair value, residual value and any associated costs, using the IBR of the lease is often the favoured approach among practitioners.

When do I need to update my Incremental Borrowing Rate?

All newly incepted leases must have an updated IBR applied to them. Entities are required to update their IBR for an existing lease liability whenever there is a change in the lease terms (a modification) or if the lessee is reasonably certain to exercise an option to purchase the underlying leased asset.

Additionally, a lessee should use a revised IBR for assessing floating rate leases when there is a change to the underlying floating rate.

How to calculate your Incremental Borrowing Rate?

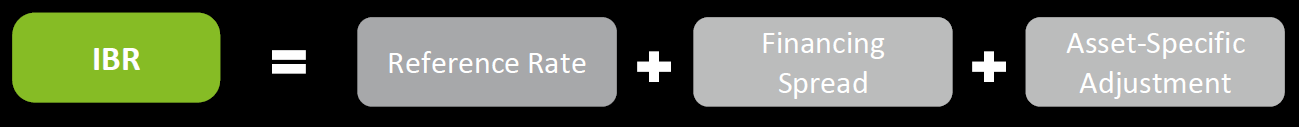

Deloitte’s approach to calculating IBR’s includes three key components:

How do I get started with Deloitte IBR Calculator?

Deloitte’s Incremental Borrowing Rate (“IBR”) Calculator allows you to calculate AASB 16 and IFRS 16 compliant discount rates to apply to your lease portfolios.

Once registered, you can access their self-service IBR Calculator at any time. You will be guided through the required calculation inputs including assessment date, credit rating, lease asset class, debt details and currency requirements to calculate your IBR’s.

You will receive a rate card from 3 months - 100 Years as well as a Deloitte-branded report to act as an audit trail for your AASB 16/IFRS 16 compliance. The report will include an outline of the IBR results, calculation methodology used, IBR breakdowns, and the user-defined inputs which were used in the calculations.

We have partnered with Deloitte to offer this easy-to-use and innovative digital application that helps you calculate an IBR tailored to your business and in compliance with the new accounting standard. By using Deloitte’s IBR Calculator, it will provide you with a detailed analysis of your lease portfolio, incremental borrowing rate methodology and provide you with accounting choices that comply with IFRS 16.

Remove the subjective judgment and have confidence that your IBR is calculated and developed by global accounting experts. For more information, please click here or contact Damon Kennedy at damon.kennedy@quadrent.com.au for a subscription price specifically for LOIS customers only.

Benchmark and Analyse Your Lease Data

Don’t Underestimate the Commercial Impacts of Your Business’s IBR

How an IBR Strategy Presents Opportunity in This Economic Environment