How to Deleverage and Manage Future Financial Risk

The historic low interest rate environment that spanned the last decade is ending. This means companies need to think about the best ways to deleverage and manage financial risk in the years ahead. Quadrent, in collaboration with PwC, recently hosted a webinar outlining how companies can use leasing as a commercial and strategic choice in today’s post-COVID world.

View the webinar recording here and keep reading below for a summary of what was discussed.

Why Lease?

Leasing provides a way for companies to implement a more sophisticated capital structure. Not only does leasing have positive impacts on an organisation’s finances, but it helps in addressing growing environmental, social, and corporate governance (ESG) concerns and is an effective tool to provide a better employee experience. Beyond addressing current hot-button issues for organisations, leasing is fundamentally about transferring the risks inherent in asset ownership.

The risk transference an organisation can achieve through leasing will depend on:

- the structure and features of the lease, which ultimately impacts the pricing.

- other factors such as asset classes, geographies, and economic conditions.

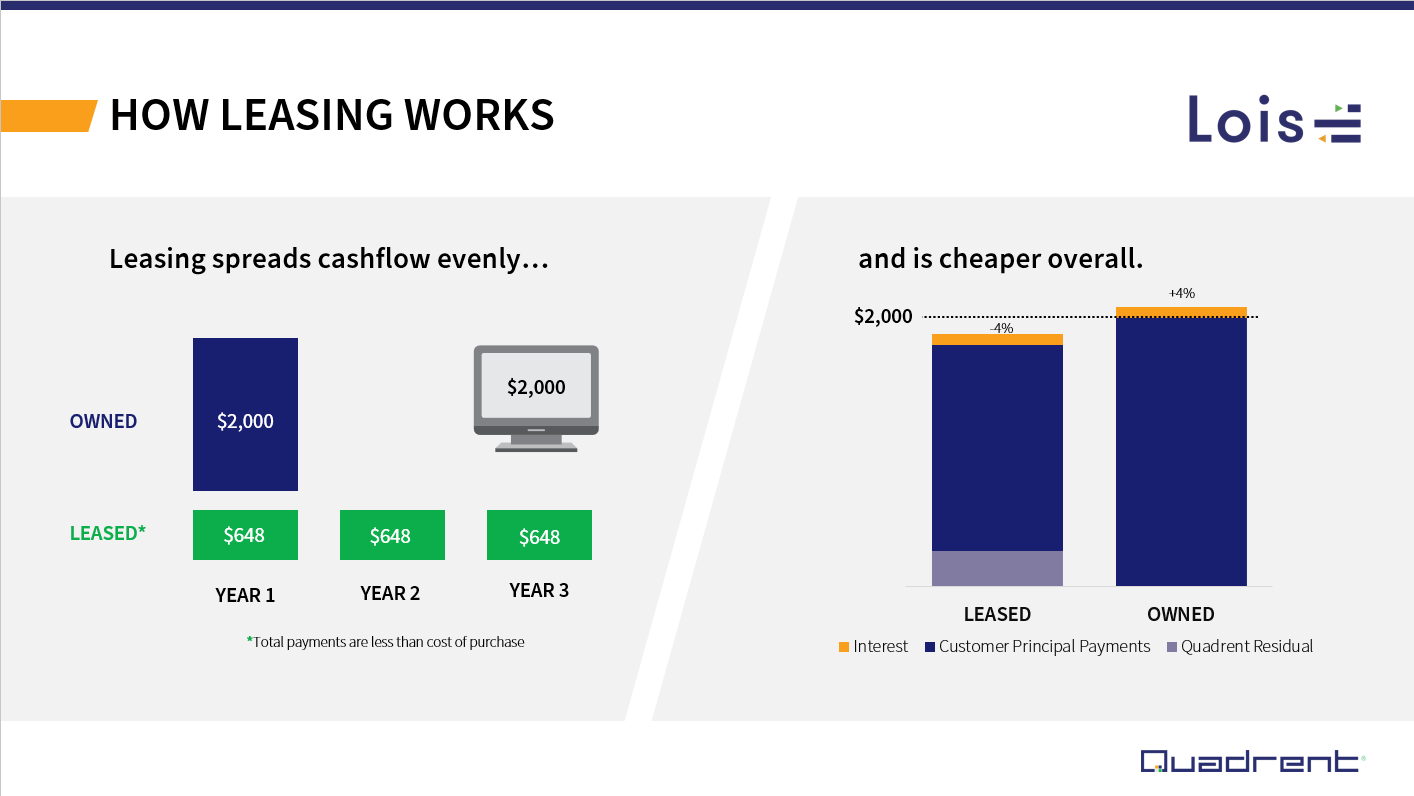

The key financial benefits of leasing are the ability to fix interest rates, and through using the lessor’s residual investment, a lease can be funded at a lower rate providing significant savings over time. Leasing also mitigates the need for large capital outlays for new assets, allowing companies to spread cash flow evenly over their useful life.

However, it’s important to note that leasing doesn’t work for all asset classes. It’s about understanding which assets, when leased, can deliver a range of commercial and strategic advantages to an organisation.

What Different Leasing Structures Can Deliver to Your Organisation

What Different Leasing Structures Can Deliver to Your Organisation

The way an organisation manages risk and derives financial benefits from a lease will depend on the asset in question and lease structure. This means it’s important to pick the right assets to lease, such as property and technology equipment. Leases that may have been operating leases before the IFRS 16 standard came into effect tend to be suitable leasing options.

To get the most value possible out of leasing, organisations should consider the risks associated with certain assets. If access to a particular asset is critical to running an organisation, owning the asset may be more suitable. An example could be a high value piece of specialised equipment in a manufacturing business. To balance the financial outlay of purchasing high-value assets, other assets can be leased where they may have once been a capital expense. Further, with the amount of data that should be captured now through IFRS 16 compliance and reporting, organisations have a wealth of information available to determine how to best use leasing for stronger financial and risk management.

Calculating the Total Cost of Ownership Will Tell You Whether to Lease or Buy

When assessing whether to lease or buy an asset, an analysis must be completed on a “like for like” basis. This analysis, ideally, should always be moving, with the ability for forecasts and financial models to be updated in real-time. Again, this is where leveraging the data collected throughout the IFRS 16 compliance and reporting process provides further value. Calculating the total cost of ownership (TCO) allows organisations to consider other costs that may not be front of mind, which provides a more holistic view of the expense involved in acquiring a business’s assets. These include interest on debt used to fund capital expenses (when buying the asset), IT support and repairs as assets age, and erasure, recycling, disposal, and transportation of the devices at the end of their useful life. Many of these processes are specialist roles that most organisations do not have.

Further, with the need to ensure technology is always up to date, smaller assets such as laptops and phones may only have a useful life of two or three years. If these assets are leased, the devices can be securely erased then recycled responsibly, or sold on a secondary market to extend the total life of the asset. These end of asset lifecycle processes also help companies make a demonstrable commitment to sustainable practices while ensuring fit-for-use equipment is always available.

Start Your ESG Journey With Quadrent

For companies looking to proactively minimise their environmental footprint and ensure a demonstrable commitment to ESG, Quadrent’s Green Lease provides a simple way for companies to start their ESG journey. Backed by green loan funding that recognises and reflects the UN’s Sustainable Development Goals 2021, our sustainable green loans are backed by the Bank of New Zealand and built into an operating lease with ESG reporting.

Quadrent works with businesses helping them to accurately manage their leases, improve IFRS 16 data inputs, and proactively manage their ESG risk. With a team that has in-depth leasing knowledge and specialised accounting backgrounds, we’ll help you get the most value out of your assets while addressing increasing ESG requirements.

Start your ESG journey simply and efficiently with Quadrent. Click here for more information.

Related Posts

You might also like

It is a fine balance between meeting the educational needs of our tamariki and managing your school's finances. Having ...

Quadrent are excited to announce the signing of our first Quadrent Green Lease agreement in Australia with Allens, one ...

In a world increasingly dependent on digital technologies, the digital divide has become a pressing concern. ...